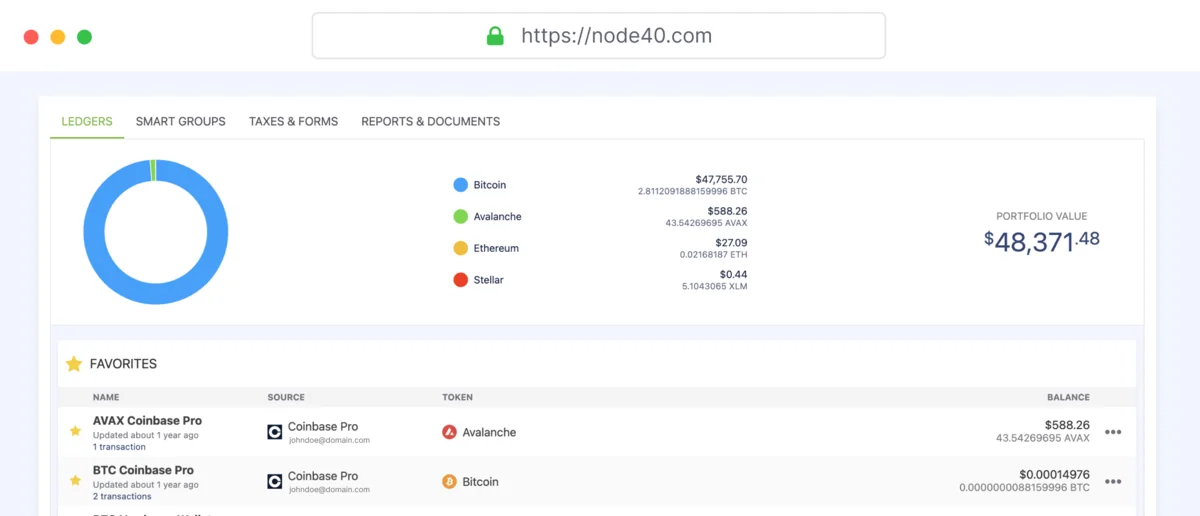

Blockchain accounting is too complicated for spreadsheets and too risky for avoidance and shortcuts. NODE40 uses tax lot identification (SpecID) to track the entirety of a transaction lifecycle and to create independently verifiable audit trails. As a cryptocurrency accountant, you can use the SOC1 Audit-accredited crypto tax software to identify transaction types, reveal cost basis and calculate gains and losses to reduce risk for your clients — and for your firm.

CPAs