The IRS unveiled the much-anticipated draft of Form 1099-DA on April 18th. It’s crucial that any entity falling under the broker category, as per the proposed rules of August 2023, comprehends the reporting obligations. With the reporting requirement set to kick in on January 1st, 2025, there are only eight months to devise a viable data schema and establish your reporting process.

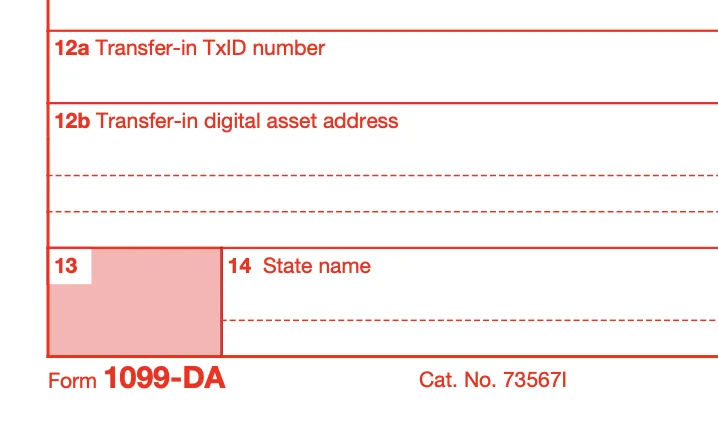

Some of our clients have asked us for clarification about boxes 12a and 12b on Form 1099-DA. Let’s delve into these to understand why there is confusion.

Here are the instructions for boxes 12a and 12b.

Box 12a. If the units of digital assets sold, exchanged, or otherwise disposed of were previously transferred into an account at the broker and that broker provided hosted wallet services for those units, this box shows the transaction ID assigned to that digital asset transfer-in transaction.

Box 12b. If the units of digital assets sold, exchanged, or otherwise disposed of were previously transferred into an account at the broker and that broker provided hosted wallet services for those units, this box shows the alphanumeric identifier that represents the origination digital asset address from which the digital assets were transferred.

https://www.irs.gov/pub/irs-dft/f1099da–dft.pdf

The instructions indicate that the transaction hash (12a) and public address (12b) must be supplied when assets are exchanged from an account at the broker, and the broker was the custodian (i.e., “provided hosted wallet services”).1

Selling Two Tax Lots in a Single Transaction

There is an obvious reporting impossibility when you sell more than a single tax lot. Let’s use a concrete example. If you have an account at Coinbase, and use their hosted wallet, trading those hosted assets will require Coinbase to report the transaction hash and public key from your hosted wallet for the traded assets.

If you move BTC from your Coinbase hosted wallet account into your Coinbase broker account (a common operation) and then trade the BTC for some other asset, boxes 12a and 12b cannot be empty, because BTC was moved from the hosted wallet account to the broker account.

Here’s where things get confusing. Let’s say you move 1 BTC from your Coinbase hosted wallet into your Coinbase broker account, and then later move 2 BTC from your Coinbase hosted wallet into your Coinbase broker account. Obviously, these are two transactions with two unique transaction hashes and two public wallet addresses.

When you trade 3 BTC for USD from your Coinbase broker account (i.e., 2 lots), which transaction hash and public wallet address do you use for boxes 12a and 12b? This question applies irrespective of your accounting methodology (e.g., FIFO or HIFO). Maybe the answer is to leave the boxes blank, but then why ask for them at all?

This is a technical flaw and the IRS will need to amend the form. For now, we’re preparing for any eventuality and will submit our comments before the June 21st comment deadline.

Why was this requirement even suggested? Currently, the Draft Form 1099-DA seems to envision transaction-by-transaction reporting. As soon as there is more than one tax lot in a transaction, the reporting requirement is not feasible. The problem goes away with tax lot reporting, but that would exponentially increase the number of forms and the cost to generate those forms. Industry experts have estimated 8 billion Forms 1099-DA will need to be filed. Based on our calculations, tax lot reporting would increase that number to well over 24 billion!

In summary, the IRS’s proposed Form 1099-DA presents some significant technical challenges and ambiguities around reporting requirements for boxes 12a and 12b when digital assets are transferred into hosted wallets. The requirement to report transaction hashes and originating public addresses becomes infeasible when selling multiple tax lots in a single transaction. This flaw will likely need to be addressed by the IRS. As the 2025 reporting deadline approaches, crypto brokers and industry experts are carefully analyzing the proposed rules and preparing to submit comments to address issues like these before the June 21st deadline. Staying ahead of the evolving reporting landscape will be crucial for compliance in this emerging regulatory environment.

I will be writing a series of articles about upcoming reporting requirements for Form 1099-DA and Form 8300. Form 8300 requires reporting of aggregate payments over $10,000. Reporting has been delayed for now, but it has rightfully caused concern in the industry.

1 Notably, in the preamble to the Proposed Regulations The Treasury Department and the IRS intend to except brokers from reporting this additional information with respect to the sale of transferred-in digital assets once rules have been promulgated under section 6045A for broker to broker reporting of transfers. Until that time, the IRS would use this “transfer in” information to verify the basis claimed by the taxpayer in connection with the sale of the transferred-in digital asset.