Introduction

Solana has emerged as a high-performance network known for its fast transaction speeds and low costs. Validators play a crucial role in maintaining the integrity of the network, but tracking their financial performance is complex. This case study explores the financial landscape of Solana validators, using an actual validator from Asymmetric Research (AR) for our data. We’ll dive into the key revenue streams pulled from three-quarters of a billion transactions and discuss the best ways of tracking these revenues and how to correctly assign cost basis and gains/losses when converting to USD.

Why a Case Study

There are more than 1,400 Solana validators worldwide with varying degrees of success. The volume of transactional data contributing to a validator’s earnings is so massive that most independent third-party blockchain analytic companies won’t, and often can’t, attempt to deconstruct validator financials. There is a concerning lack of expertise in this area. AR, along with NODE40, believes the long-term viability of validators will depend, in part, on services able to distill this data down into familiar financial reports used to inform business decisions and comply with local tax authorities.

Disclaimer: In the examples throughout the case study, we’ve purposely excluded USD values when doing so would expose more information than necessary to illustrate a particular point. The goal of this study is not to focus on how much money a specific validator makes but rather to demonstrate that deconstructing revenue and expenses is challenging but achievable and that failure to do so exposes operators to more risk than may be acceptable to their organizations.

Profit Optimization

The expertise required to build, configure, run, and maintain a validator is in short supply, and its costs can eat away at revenue. Owners need to optimize their validators to extract as much value as possible, but optimization is essentially an educated guessing game without good data on revenue streams and expenses.

Transparency and Attracting Delegators

Some validators must disclose financial information to investors and third-party auditors. A breakdown of where value is sourced clarifies performance. Some of this information can be used to attract more delegators by disclosing past performance of key indicators such as average blocks validated per day, average fees earned per validated block, and average Jito tips delivered per epoch—denoted in USD as well as SOL.

In July 2024, the AR team contacted NODE40 to request financial reports on their Solana Validator performance. They needed the same analytic reports they were getting from all the other chains NODE40 supported. However, the NODE40 Solana analytics at the time were limited to reporting on common individual uses like buying, selling, swapping, etc. Validators are complex, so to support them, NODE40 needed a technical crash course, and there is no better group to give it than the team of experts at AR. Over several weeks in July, through conference calls, emails, and Slack messages, AR patiently described in intricate detail how Solana validators operate and outlined the technical implementations of various revenue streams. By the end of July, we were confident we could build and deliver what AR requested.

What AR Needed

AR needed to know how much income the validator earned and when it was earned and see the cost basis for each income lot received. Anytime AR converted SOL to USD, their accountants needed visibility into gains and losses backed by specific tax lots.

The requirements were no different from those of any other digital currency activity. Still, the scale was massive, and uncovering how income was received proved more complicated than expected. A breakdown of the process we followed to get it done follows.

Validators make money in a variety of ways. For this case study, we’ll discuss three revenue streams plus one expense: voting:

- Commission on Inflation Rewards

- Jito Tips

- Transaction Fees

Tracking Income

Before engaging NODE40 to work with its accountants, AR carefully tracked income from its Solana validator reasonably and consistently by periodically transferring earned SOL to an exchange. Since exchanges assign a basis when users deposit digital assets, the value received in USD after exiting from SOL would be loosely correlated to revenue.

Without detailed financials from NODE40, this approach was the best to be hoped for and demonstrated a willingness to get their numbers as correct as possible. However, this approach has enough drawbacks that AR wanted to perfect it or at least get closer to it.

Limitations of the initial approach were rooted in the differences between the value deposited onto an exchange and the value when the digital asset was received and included, in part, the following.

- The value assigned at deposit is not the same as the value of assets when received as income, so the cost basis is wrong.

- Gain and loss calculations are less reliable because hundreds, thousands, or millions of tax lots are combined into a single lot several days after creation, making the cost basis higher than reality (assuming the general upward trajectory of USD/SOL, which has been observed).

- Using the value of USD received from selling on an exchange (plus or minus the gain/loss) as a proxy for profit combines revenue and expenses with no way of separating the two, which must be reported separately.

- The divergence between correct and estimation grows over time as transaction volumes increase and the price of 1 SOL rises, forcing the operators to tolerate more risk.

- Operators cannot make highly informed decisions about configurations or disclose accurate financial information to interested parties. Instead, USD conversions must be used as a proxy for decision-making.

Volume of Data (767M transactions/year)

Our preliminary research made clear we’d be dealing with a lot of data. To estimate the expected size of the data set, we sampled epoch 663 at random and examined how many transactions contributed to AR’s revenue and vote fees.

A Note on Solana Epochs

In Solana, an epoch is a period during which the validator set is consistent. After the end of each epoch, staking rewards are distributed to delegators and validators.

Each epoch is divided into slots, each a potential block. If a slot is missed, it still counts towards the epoch, but no block is produced. The exact duration of an epoch varies because the network’s performance and slot times can fluctuate, but each epoch is fixed at 432,000 slots, with each slot having a target time of 400ms. This puts the general epoch length between 2 and 3 days, or about 146 epochs annually.

AR Validator

For this case study, we used data for 8 months of 2024 between Feb and Sep and epoch 663. Epoch 663 began on 2024-08-28 at 20:55:33 UTC and concluded on 2024-08-31 at 00:52:00 UTC, lasting about 52 hours.

Inflation Rewards (146 transactions per year)

Inflation rewards are paid to delegators, and validators charge their delegators a commission to cover operating costs and make a profit. The commission is paid to a validator’s vote account.

Since Inflation rewards are paid out after an epoch ends, and we are assuming 146 epochs per year, we should expect to receive around 146 lots as income from commission on inflation rewards.

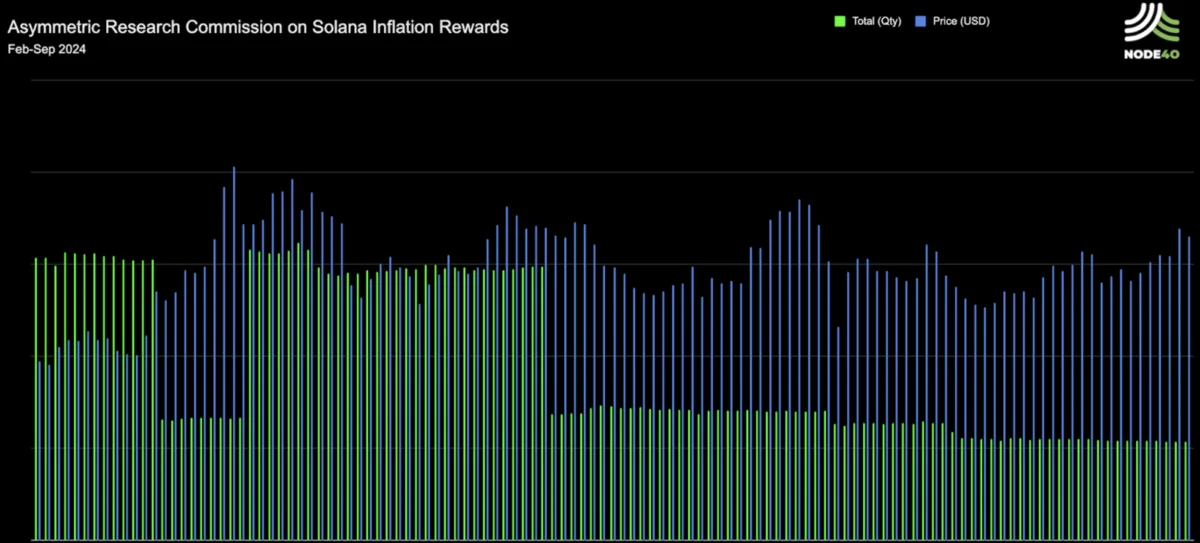

In Figure 1, you can see the revenue from inflation rewards over time in green. The USD price per SOL is added to illustrate price volatility. Price volatility makes tracking financials at this level necessary for correct tax reporting. Charting individual streams can also draw attention to patterns that may be important to an operator. The sharp drop in revenue in Figure 1 was a deliberate change in commission from 10% to 5%. You can gain much better insights into specific revenue stream performance by tracking revenue streams independently.

Jito Tips (2.2M transactions per year)

Jito tips are an additional revenue stream for Solana validators participating in Jito’s MEV-Protect infrastructure. In this system, users can include tips in their transactions to incentivize validators to prioritize their transactions.

Validators supporting Jito’s MEV-Protect receive these tips directly into their vote accounts at the end of an epoch but are aggregated in a separate related account throughout the epoch. This extra income adds a new layer of revenue, but tracking it requires additional effort since these tips are distinct from regular transaction fees and rewards.

Jito Tip Delivery and Distribution

A new account is created for a Jito-enabled validator for each epoch, where the tips are delivered in real time. The catch is that the tips cannot be withdrawn until after the epoch ends (similar to inflation rewards). Like inflation rewards, the delegators receive tips after paying a commission to the validator vote account. Jito handles this distribution activity automatically.

Epoch 663

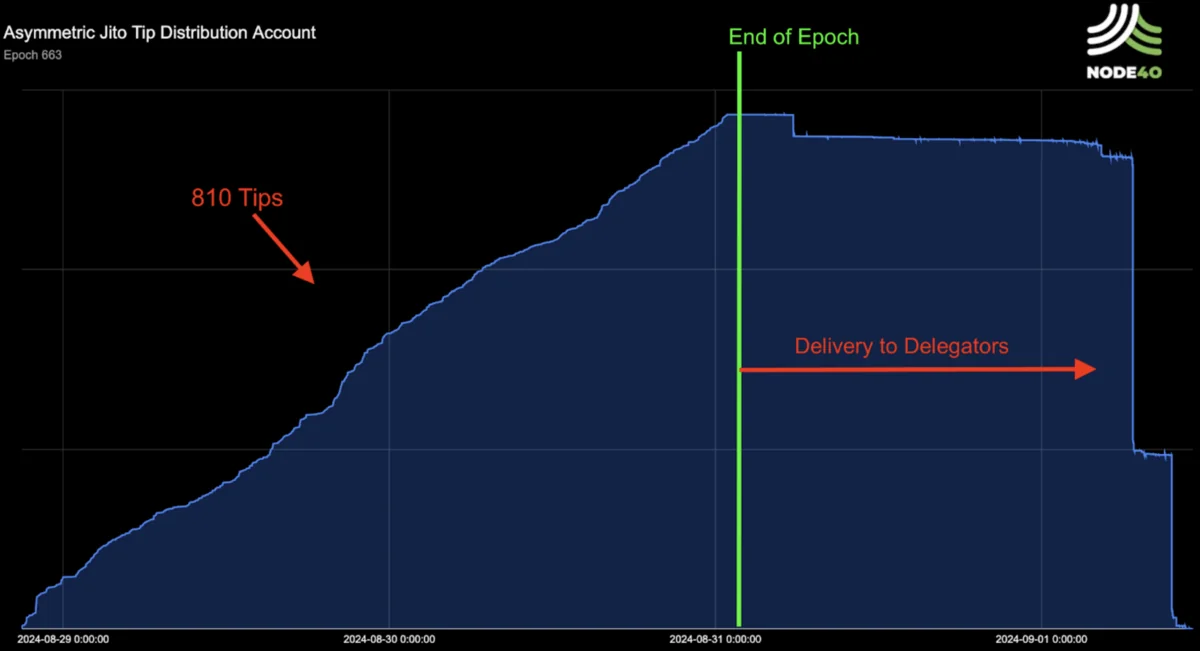

Throughout epoch 663, Jito distributed a total of 57.22312754 SOL to AR’’s Jito Tip Distribution account (FTSUw1ZBSRDcNht1Ha3MTsTJntgftrd5t6iETvunhrEF) consisting of 810 transactions. This is a small percentage of the 4.7M transactions included in the 3,279 blocks AR validated in the epoch, but a material amount of SOL.

FTSUw1ZBSRDcNht1Ha3MTsTJntgftrd5t6iETvunhrEF is a Program Derived Account (PDA) that is discoverable by programmatically deriving the account using the Jito Tip Distribution program account and the epoch number (663) as inputs. Once the epoch ended, Jito automatically distributed the accrued 57 SOL to the 14,786 delegators.

Figure 2 shows the accumulation of 810 Jito tips up to the end of epoch 663 and their distribution to 14,786 delegators plus 1 to AR’s vote account.

Using only this epoch as a sample, a rough estimate of transactions per epoch is around 15,597. Further, assuming 146 epochs per year, we arrive at 2.3 M Jito-related transactions per year for AR.

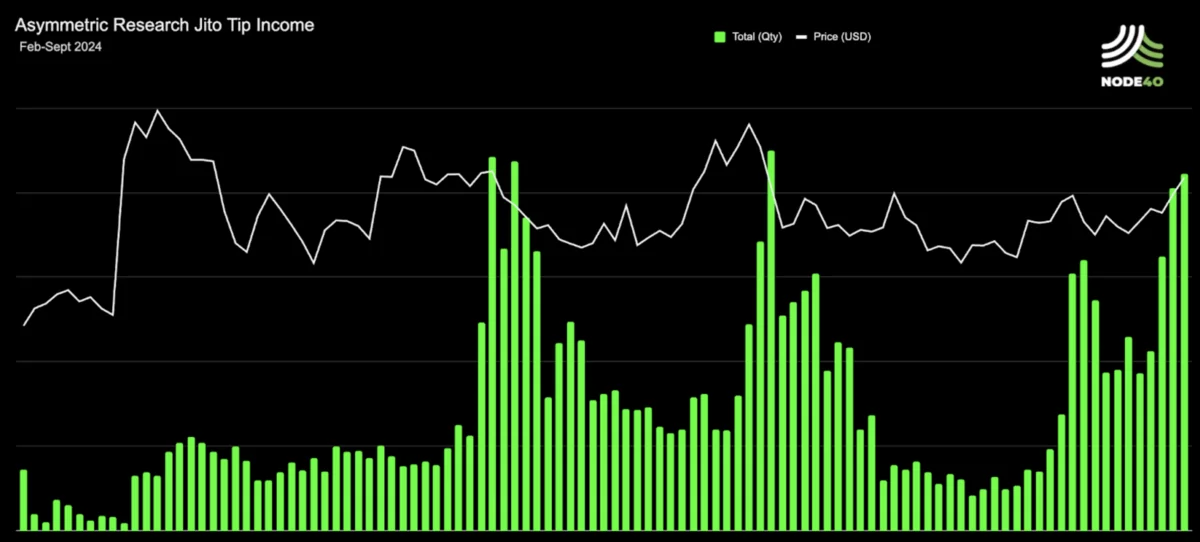

Figure 3 shows Jito tips in SOL delivered to AR over time. We expect to see peaks and valleys in this chart because Jito tips increase during network congestion and decrease when the network is under less load. Again, we’ve included the market price of SOL over the same time scale to show that reporting income based on periodic USD conversions can be materially different from reality.

Transaction Fees (686.2M transactions)

Like most blockchains, Solana validators receive transaction fees for processing transactions and adding them to blocks. Each transaction submitted to the network includes a small fee.

When a validator successfully writes a block, the transaction fees from all the transactions included are immediately paid to the validator’s identity account. As stated above, AR validated 3,279 blocks in epoch 663 consisting of 4.7M transactions. This resulted in a combined 13.590528365 SOL earned from transaction fees in the epoch. To estimate the number of transactions from which AR will earn fee income in one year, we can multiply 4.7M transactions by 146 epochs to arrive at 686.2M.

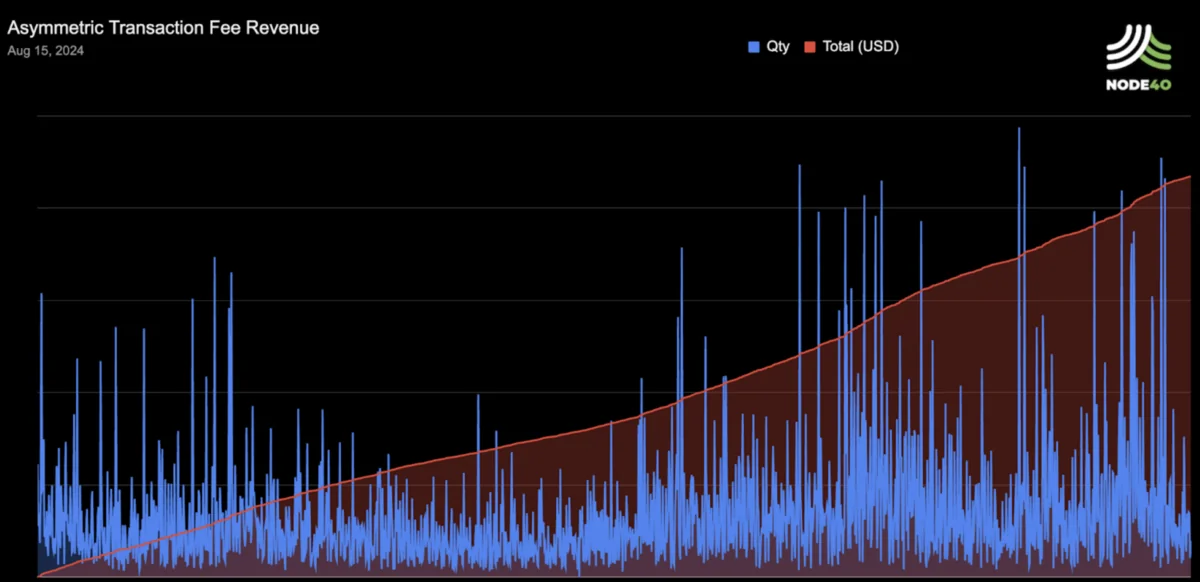

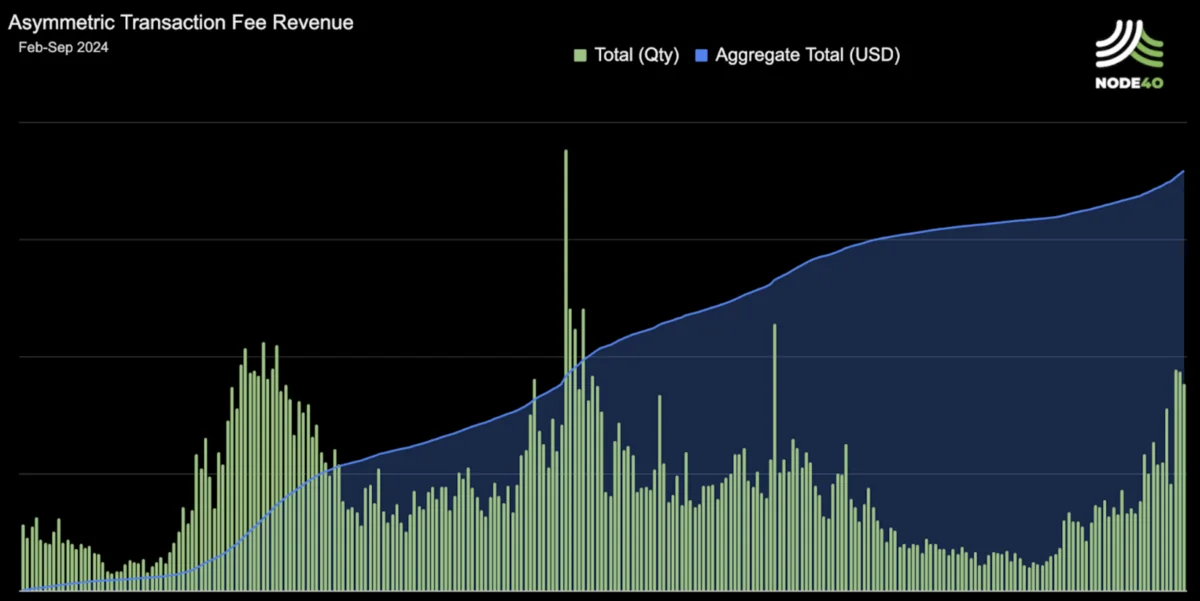

We faced a problem dealing with high transaction volumes from which fees were earned. We decided to explore a single day to get a handle on the activity. On Aug 15, 2024 (chosen randomly), AR wrote 1,519 blocks comprising 2,481,301 total transactions. Each transaction paid a fee. Since our job is to turn data into actionable information, handing a report to a CFO containing 2.4M daily records would not be actionable. We decided to aggregate transactions by validated block and graph it to see if we could learn anything.

Figure 4 illustrates the accrual of transaction fees earned for each block validated by AR on August 15, 2024. You can see the accumulation of Total (USD) is remarkably consistent. This gave us confidence in using aggregate data to report earned revenue from transaction fees. Still, even the aggregate data was unwieldy to digest, so we further reduced the data into daily summaries. This allowed us to take data from 2.4M transactions and summarize their earnings in a single ledger entry. We were comfortable with this approach since actual blockchain data back the summaries.

Figure 5 zooms out to the full-time period.

Example summary description for a ledger entry

Daily rollup of tx fees earned for block validation (blocks validated: 1644, Avg/Block: 0.011 SOL)

Vote Fees (78.8M transactions)

Validators vote as part of their core role in maintaining the network’s consensus. They vote to confirm and validate the correctness of blocks produced by other validators. In Solana, validators pay 0.000005 SOL to cast votes, and they cast many of them.

You can calculate the maximum cost of voting for a validator per year by first calculating the number of blocks per day: 1 block/400ms (2.5 blocks/s) * 86,400 seconds/day, which brings us to 216,000 blocks/day, or 78.8M votes/year. This makes the most a validator will pay daily to vote 1.08 SOL/day. We like it when known limits exist because it allows a self-checking mechanism in automated processes. For example, if we observed that a validator paid more than 1.08 SOL in a single day to vote, it could mean a bug has been introduced into the process, or maybe just the fee to vote has increased.

.

We faced the same volume problem as with transaction fee income. Comfortable now with summaries, we took the same approach and summarized vote fees daily to reduce 60M ledger entries to just 365 (1 per day per year).

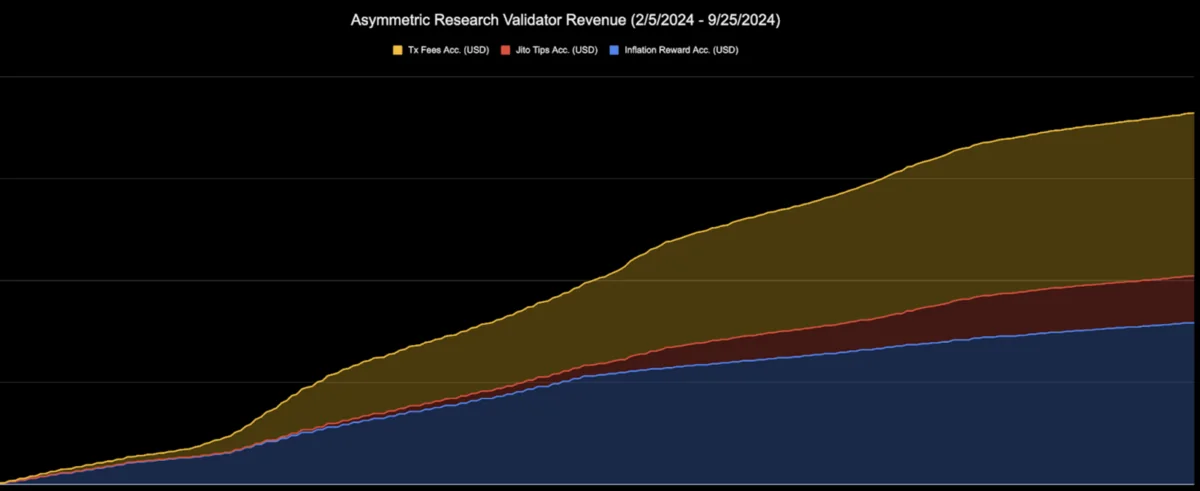

Revenue Breakdown Results

Correctly identifying where your revenue is coming from cannot be overstated. The more insights you have into your validator’s performance, the better. However, having the details necessary to back up your tax and accounting entries can become critical in the years to come as tax authorities scrutinize large earners in this space. Even well-intentioned owners paying taxes to the best of their abilities can find themselves unable to answer basic questions from auditors about where these numbers are coming from.

Conclusion

The financial performance of Solana validators is inherently complex, requiring a detailed understanding of diverse revenue streams, including commission on inflation rewards, Jito tips, transaction fees, and voting costs. Using AR’s validator as an example, this case study demonstrates the challenges and solutions in accurately deconstructing these financials. By collaborating with NODE40, AR gained precise insights into their validator’s operations, ensuring compliance with tax requirements and enabling better business decisions.

NODE40’s approach to aggregating and summarizing high volumes of transaction data—totaling nearly three-quarters of a billion transactions annually—allowed AR to convert vast, granular data into manageable, tax-compliant reporting. This level of detail is crucial not only for optimization and transparency but also for attracting delegators and minimizing risk as the regulatory scrutiny on digital assets grows.

Further reading: For ETF operators staking SOL, the same granular accounting requirements now apply under Revenue Procedure 2025-31 for Solana Staking ETFs.

About NODE40

NODE40 is a leading blockchain technology company focused on providing advanced digital asset tracking and reporting solutions. Founded by Perry Woodin and Sean Ryan, NODE40 delivers comprehensive tax lot-level reporting and cutting-edge solutions to institutional clients, auditors, and individual investors, ensuring accurate and compliant management of digital assets across multiple platforms.

About Asymmetric Research

Asymmetric Research (AR) is a Web3 security and infrastructure provider dedicated to safeguarding Layer 1 blockchains and DeFi protocols. Focused on enabling secure innovation through long-term partnerships, AR acts as a core contributor, delivering tailored security solutions and critical infrastructure to clients. Recognized as a high-trust partner, AR empowers founders and project leaders to navigate the complexities of the blockchain when the stakes could not be higher.